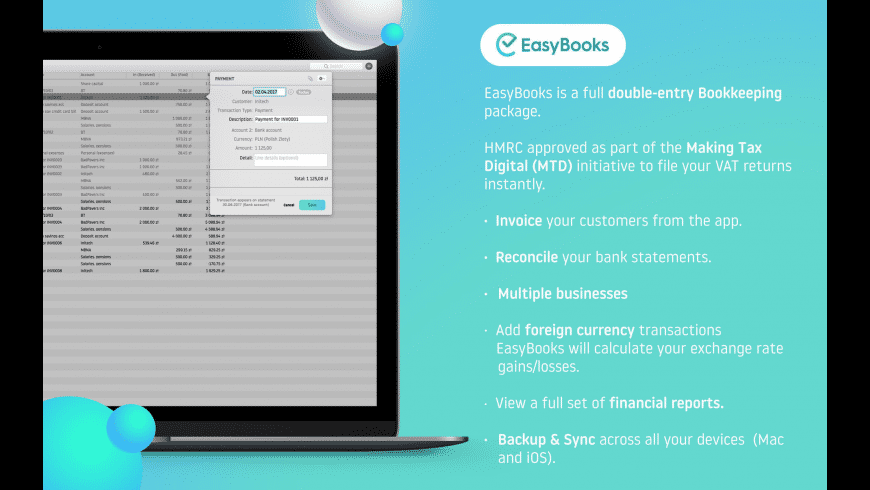

GnuCash is based on double-entry accounting for balanced books and you can run a number of reports to see your financial data. GnuCash also offers small-business accounting tools that let you manage customers and vendors, handle invoicing and bill payment, and even payroll. GnuCash is compatible with Windows, Mac OSX, GNU/Linux, BSD, and Solaris. Small Business Accounting Software for Mac. What Does It Do? EasyBooks keeps track of all your accounts, statements, invoices and VAT (Goods and Services Tax). You can enter Sales, then generate invoices in PDF format to email to your customers. You can produce a full profit and loss and balance sheet for your accountant and complete your VAT.

Budgeting is a discipline that’s not often met with excitement. Many assume that budgeting is something reserved for companies or, say, freelance workers. However, personal budget software is just as important as corporate one — it’s a fundamental understanding of where money is coming and going.

You may consider it to be boring, tiring, time-consuming, or difficult, but managing your finances well can help you achieve goals and stave off the stress of a rainy day. Thankfully, there are tools and apps on Mac which can help you get on top of budgeting, no matter how experienced you are.

Why Should I Use Budget Tracking Software?

Home Accounting Software For Mac Free

If you haven’t done a budget before, you should start now. You never know when you might need a particular sum of money to solve an issue, meet a goal, or take advantage of a sudden opportunity.

Budget programs help you reduce the stress and uncertainty that comes with not knowing where you stand financially. If you don’t have a home budget software, you might be tracking towards a situation where you run out of money, without even knowing it. If you do have a budget, then you’ll have a documented plan of action to improve your situation.

Importantly, you don’t need any qualifications to do a budget, nor do you need to be good with numbers. Take advantage of the best budget software for Mac to help you take control of your finances without the hassle. Budgeting tools come in many shapes and sizes, so selecting the right one for you depends on personal preference and previous experience with managing money.

Handy tips for budgeting tools

If you’re ready to start your budget, it’s best to consider a strategic approach to ensure maximum utility. Too often, budgets sit collecting dust after being created, and sometimes the act of creating a budget could feel like enough to satisfy financial concerns — it’s not. Here are some tips for making the most out of your budget.

First of all, definitely use an app to help you manage a budget. App developers invest a lot of time and money into figuring out how their software can make your life easier and better, so rather than trying to understand all the nuances for yourself, let a dedicated app do it for you. There’s even some free budget software around, so you have very few excuses not to try!

If you run a business (or freelance on a side), a little bit of work each week means end of year taxes are a breeze. It’s not about doing a marathon of work in a few days, but making a habit to consistently do a little bit here and there. Try aiming for 10 minutes every few days. The best tax preparation software will also have reminders and notifications to help you achieve this goal.

It might sound contradictory, but budgeting isn’t always about getting the numbers 100% accurate. When it comes to tax preparation software — sure. But budgeting is mostly about understanding where your money is being spent and then using that information to make more informed decisions going forward. Therefore, make sure you categorize your transactions so that it’s easier to spot those minutiae differences and trends. The best finance apps should do this for you automatically.

In summary, you want to ensure you take advantage of the online budgeting tools available to you, aim to update your records frequently, and focus on categorization over accuracy.

Features of good personal budget software

The best personal budget software for Mac is easier to pin down when you know exactly what you’re looking for. Not all apps are the same — they vary by function and pricing. Generally speaking, there are a few key features you want to see in your budget software for Mac:

It should be simple and easy to add new records or transactions

Importing bank and credit card statements should be possible

Automatically synchronizing statements will take the edge off your manual inputting

Useful dashboards or visuals will help you understand your situation at a glance

You should be able to categorize your transactions into groups

Out of those five key points, the ability to import is often the most essential. Importing saves you the hassle of adding each transaction into the money management software line-by-line, which adds up to a lot of time. It’s hard enough already to schedule frequent updates to your budget, so if you can remove the largest friction point of manual entry, then you’re in a good place.

The best budget software for Mac comparison

When it comes to programs to help budget money, there are countless options. It’s easy to get lost diving deep into each budget software review, but here are some of the best available, ranging from beautifully basic to powerfully advanced.

You’ve probably heard of Quicken, given that the name has been around since the early 80s. Even then, it was known as one of the best tax software companies around. That says something about the strong product, which carries all of the basic functions you’ll need to manage your budget well.

Right away though, you might notice that the interface has become somewhat dated in comparison to the newer contenders out there. But one of Quicken’s praised features is the ability to download bank statements and have the records automatically categorized, which can drastically reduce the time it takes to input your information, so you can spend more time making sense of it. Sadly, the Mac version is somewhat limited when it comes to advanced features, unless you splash out for the Home and Business edition.

MoneyDance is very similar to Quicken in terms of its basic features, including the ability to create a budget with notifications for bills and invoices. It also allows you to make your own charts and graphs to monitor spending habits over time, which can be seen on the homepage for a quick glance of your activity. Out-of-the-box integrations with online banking services also make it easy to send payments.

Unlike Quicken, Moneydance has some more advanced features including an investment monitor, which tracks your investments and their fluctuations — a useful addition, although best for the intermediate to advanced user. The app also has a developer API system in place to allow extended functions, mostly good for power users. Importantly, security is not an issue, as Moneydance utilizes end-to-end encryption for your data to give you that extra peace of mind.

You Need A Budget, also known as YNAB, is budget tracking software that runs on both Windows and Mac via web — saving automatically to the cloud, which is a bonus for multi-platform users. It also features native apps for iOS and Android, so you can literally tackle your budget from anywhere.

The app itself follows a simple design language, which is perfect for beginners, but if you find yourself needing help you can sign up for a personal instructor. YNAB doesn’t let you slack at all, and if you start to stray from your budget, the app will raise a red flag through it’s built-in Accountability Partner.

Although YNAB doesn’t support the ability to download and automatically categorize records from bank statements, it could be argued that entering them manually helps the user pay more attention to where their spending is going. Still, it’s a more time-consuming process that might be problematic for users processing hundreds or more records each month.

MoneyWiz stays true to its name — a comprehensive budget software and investment tracker that’s packed full with over 400 useful features. View your financial situation quickly by browsing accounts, groups, or searching for individual records. Speaking of records, you can enter them manually or have them automatically sync with leading banks, cryptocurrency exchanges, and financial services for an accurate real-time understanding of your accounts.

With all of this data in hand, MoneyWiz can prepare and export over 50 reports to help you gain deeper insights into your finances. Your data could be accessed from its cloud-based app or straight from the native software for Mac. All in all, MoneyWiz is extremely powerful: accessible for beginners and interesting for the most advanced users.

Receipts is yet another money management software for Mac, and is specifically well-known for its clever handling of invoicing. Using Optical Character Recognition (OCR) technology, Receipts automatically reads and translates important information about your bills, such as amount, date, currency, and more (even if the text is in another language).

Besides, Receipts can issue payments for invoices directly using third-party providers, such as iFinance and BankX. The OCR technology alone makes it a strong contender against other more simple online budgeting tools. Not least, Mac users will be glad to see how this application was designed to look and feel like a macOS product. Using a familiar user interface could make life a little easier after all.

Between the five options above, you have a strong starting point for your budgeting tools depending on your experience. Remember that importing is one of the key features to look for in budget programs. Still, in order to find the best fit you might need to try a couple of different options.

Thankfully, both MoneyWiz and Receipts have a free 7-day trial that you can take advantage of by heading over to Setapp, an app subscription service for Mac that gives you access to over 150 macOS apps, including all the necessary budget tools. Getting MoneyWiz and Receipts at once? You won’t be disappointed.

Meantime, prepare for all the awesome things you can do with Setapp.

Read onSign Up

2020-09-03 17:49:40 • Filed to: Business Tips • Proven solutions

It can be difficult to keep on top of busy accounting tasks if you lose track of your payments. That’s why, in today’s business environment, more and more businesses have embraced digital accounting software to make their lives easier. For businesses looking to manage their finances, there are a wealth of accounting software packages on the market to make this task easy and cost-effective. Given the variety of packages on the market it’s important to do your research to find the right software for your business. Below, we take a look at the best accounting software for Mac (including macOS 10.15 Catalina). for small and medium business.

Best 5 Accounting Software for Mac

1. FreshBooks

For small and medium sized businesses or personal users that are seeking a seamless solution for their payment, invoicing and payroll management needs, FreshBooks is one of the best and simplest solutions. This accounting software package is suitable both for on-premises accounting applications and cloud-based versions of business’s accounting functions. It has many web-based features including electronic payment, remote payroll facilitation, online banking and reconciliation, and mapping features. The versions from 2008 onwards also allow you to import data to Excel spreadsheets so you can generate custom reports more easily.

Pros:

- Includes basic functions

- Low Cost

- Easy to use interface

- Flexible with third party applications

Cons:

- Lack of advanced business-specific features

- Double entries and keying errors

- File size issues

2. FreeAgent

FreeAgent is a particularly handy software that enables SME’s to set up recurring invoices and automated reminders to keep on track of accounts ‘hands-free’. The expense tracking feature helps users to track their spending by taking pictures of their receipts and uploading them to FreeAgent so they can be automatically processed. This means that you don’t have to put in the legwork of processing receipts yourself. Likewise, near tax time, sole traders and limited company directors can submit tax returns in a single click. In addition, SMEs will benefit from the overhead view of their accounts and automatic bank feeds, enabling users to import bank transactions directly.

Pros:

- Simple and effective dashboard system

- Automated Receipt Processing

- Fast one click tax returns

- Real time view of cash flow

Cons:

- Core functionality is limited

- Inventory tracking is confusing

- Doesn’t have the capacity to support larger businesses

3. Xero

Xero is now a well-known name among Mac accounting software, due to its great interface and richness of functionalities. Functional on both PC as well as Mac, what makes it widely preferred is its ease of use. Xero doesn’t compromise on features even on the Mac version. A great thing about it is that there is no binding contract and the user can cancel their subscription at any time.

Pros:

- Real-time account monitoring available on mobile

- Multiple third-party apps included

- Simple layout

Cons:

- No way to add a digital signature

- Can’t create new business documents

4. ZohoBooks

The user interface makes it easy to send professional invoices to clients from day one, whether you’re on a desktop or iPhone. Automated banking allows you to connect Zoho to your bank account for a real-time update on your transactions. Organizations are able to track inventory in real-time. The Client Portal allows you to share recent transactions, accept bulk payments and process customer feedback. One particularly useful feature is the ability to attach expense receipts. Zoho Books allows you to capture all your receipts in one place (You can also take a picture of your receipts to upload them onto the system).

Pros:

- Competitive price

- Professional invoices are easy to send

- Automated banking allows you to stay on top of your accounts

Cons:

- Can’t complete a payroll

- Receipts can feel disorganized

- Can’t create PDF files

5. WaveAccounting

With Wave Accounting, a free accounting software mac, users can create and send professional invoices and receipts. The invoice system is particularly quick, with most client invoices cleared within 2 days. Payroll enables business owners to pay their workforce easily, with direct deposits and online pay stubs to save you leg work. Whether payments are by the hour or by salary, payments can be made every week, every two weeks, or monthly.

Pros:

- This accounting software mac is very cost effective

- Solid invoicing, accounting, and receipt scanning features

- Flexible Payroll features enable you to pay staff as you need

Cons:

- Pay-as-you-go service can be an inconvenience

- Advertisements are distracting

- Limited customer service

Unlock the Full Potential of Accounting Software for Mac

As Mac computers have evolved, they’ve solved many day-to-day business problems, reducing the time and resources needed to achieve business goals. This applies to your accounting problems as well. Accounting software for Mac computers has made business accounting much simpler and more effective. But while this software has resolved many problems it doesn’t come without limitations. Processes like transitioning from hard copy to digital documentation, or making work more flexible and collaborative are not issues that are easily solved.

Offering a complete solution to fill the gaps in accounting processes, PDFelement is a valuable addition to your software inventory. All accounting documentation becomes flexible and open to collaboration with this simple, effective software program. Transform all file types into editable PDFs in minutes and collaborate on documents (commenting, annotating and redacting) all within one interface. Create fillable forms, combine multiple documents, and extract data for analysis. This will reduce the time needed to complete projects in-house and deal with external clients. PDFelement is your toolkit for complete accounting success.

Export data into an analysis-ready format

Mac Accounting Software

Manually extracting and exporting data has always been one of the biggest headaches for accountants. Hours and hours of valuable working time are wasted each year copying and analyzing data from paper forms, or manually inputting that data into digital programs. It also leads to mistakes due to human error. Leave this issue in the past with PDFelement which allows you to extract and export data at the click of a button.

To simplify the process following data extraction, all data can be exported as analysis-ready files for Excel so that that data can be further analyzed and worked into financial reporting. With full customization of data forms and batch exporting available, PDFelement massively reduces the resources needed when working with financial data.

Automatic form field recognition on PDFs

Filling out forms, and processing them, is a central part of accounting work. This is always a very time consuming task – manually printing, filling out and sending forms wastes hours of accounting effort. Most accounting programs for Mac haven’t been able to solve this problem, but using PDFelement alongside your accounting program will massively reduce the time spent working with forms in your accounting workflow.

Preserve industry-standard PDF files accurately

High documentation standards are required within the accounting industry. When creating, or converting other documents to PDF, PDFelement will ensure all files adhere to the International Standards Organization (ISO) standards for both PDF and PDF/A documents.

This means that all your documents can be saved, shared and sent across all platforms to any colleague or client with complete peace of mind. PDFelement makes this simple, efficient, and safe by ensuring that the highest standards are always maintained.

Create fillable and editable forms from scratch

PDFelement offers simple drag and drop functionality to create fillable, interactive forms from scratch. This is something that has traditionally taken a lot of time, effort and skill to complete.

The specific ‘form’ section in the program’s editing interface offers all the elements needed to create every type of form including creating form fields, tick boxes, buttons, combination boxes, and digital signature boxes. All the other editing and creation tools work effortlessly alongside the form creation features so you can create robust and user friendly forms for all your accounting requirements.

Secure confidential accounting files with password protection

Security is an ongoing issue with accounting documents that can cause major issues when mistakes are made. Controlling access to your accounting files is essential in the digital age and PDFelement, again, is the best solution for this problem.

Simply add passwords to encrypted files and manage and change multiple passwords all within the ‘Protect’ tab of PDFelement’s software. This offers complete control of your accounting documents and lets you limit who can open and view sensitive data in a manner that traditional accounting software for Mac cannot.

Protect specific, sensitive content with the redaction function

Document protection doesn’t always just mean restrictions over the whole document. Increasingly, different members of staff, or clients, need to view different content within the same file, and be restricted from others. PDFelement can help you solve this problem in minutes!

PDFelement’s ‘Protect’ tab also offers a simple tool to redact specific sections of a document, either with block redaction or redacting specific words throughout the whole document via an intuitive search function.

Several different redacted files can be created within minutes.

Use OCR to create quality, editable, digital files from paper documents

Paperless working is a goal of most modern businesses, and accounting is no different. A paperless office can have a huge positive impact on the day to day success of an accounting department.

When wondering how to effectively convert thousands of paper documents into a digital format, many businesses have often found this a difficult issue to solve. Advanced Optical Character Recognition (OCR) is a feature within PDFelement, detecting exact characters and letters on scanned documents and converting them to make the scanned files editable and searchable once they are saved to your systems. Thousands of hours can be saved when converting documents and managing all files will become easier with PDFelement.

If you are a Windows user, you can check out Top 5 Accounting Software for Windows. For those who are searching for online or cloud solution, please check out Online Accounting Software here.

Free Download or Buy PDFelement right now!

Free Download or Buy PDFelement right now!

Buy PDFelement right now!

Buy PDFelement right now!

0 Comment(s)